Economic substance notification Dubai, Sharjah, UAE

Economic substance reporting Dubai, Sharjah, UAE Economic Substance Regulation services

Impact of Money Laundering in Economy

Money laundering is a major financial crime that can have significant impacts on the economy of a country, including the UAE.

Enhance your Accounting Procedures

Accounting is a crucial aspect of any business. It involves keeping track of a company’s financial transactions, measuring, and sharing financial activity, tracking taxes, making payments, and sending invoices.

CFO Strategic Thinker!

The role of a Chief Financial Officer (CFO) has evolved over the years from just managing financial reporting and accounting functions to becoming a strategic partner in the organization.

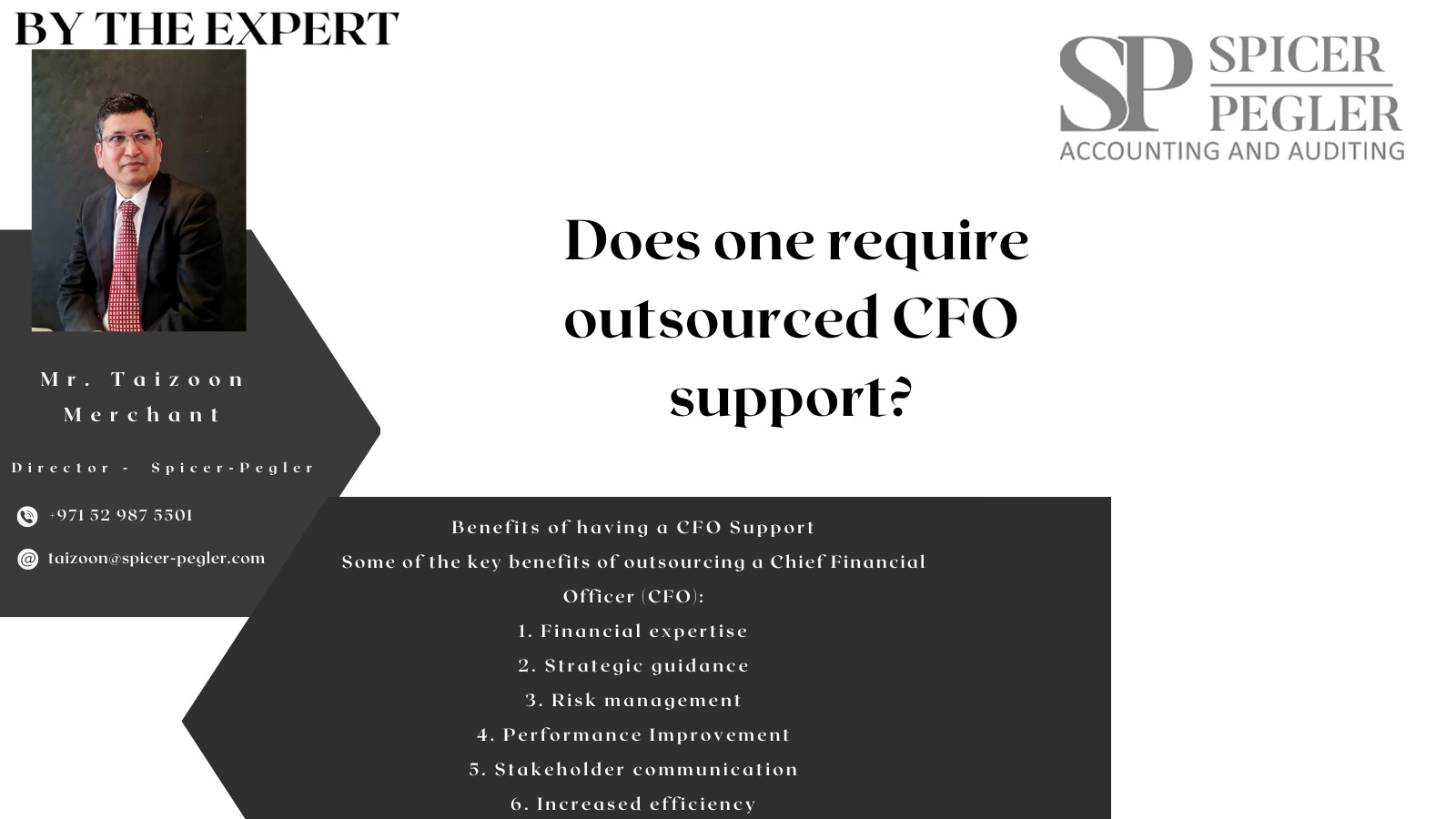

The Role of A CFO Support

The role of the CFO in financial planning and budgeting is to provide leadership and oversight within an organization.

Importance of Anti Money Laundering

Tax evasion is the method involved with disguising the returns of criminal operations as genuine assets. Terrorist financing, on the other hand, refers to the provision or collection of funds, by any means, directly or indirectly, with the intention that they should be used or in the knowledge that they are to be used, in full or in part, in order to carry out terrorist acts.

Role of Corporate Tax in Real Estate Sector

The Corporate Tax (CT) law will be starting from June 2023 as per the Ministry of Finance (MoF) of UAE. The law includes all the people including the natives and residents, with commercial or trade licenses to run business projects in the state.