Unlocking the Corporate Tax Period: A Comprehensive Guide to Ensuring UAE Tax Compliance

For businesses operating in the United Arab Emirates (UAE), understanding, and adhering to corporate tax regulations are essential. One critical aspect to consider is identifying the tax period, which holds significant implications for tax compliance and filing requirements. In this informative article, we will explore the intricacies of the corporate tax period, including its definition, submission deadlines, and associated consequences.

The tax period, as defined by UAE authorities, refers to the financial year or a portion thereof for which businesses must file their tax returns. As per the decree, the corporate tax period aligns with either the calendar year or the twelve-month period corresponding to the taxable person’s financial statement preparation.

If a taxable person wishes to modify their tax period, such as adjusting the start or end date or adopting an alternative tax period, they can submit a formal application to the relevant authority. It is crucial to note that any changes requested are subject to specific conditions determined by the authority.

Now, let’s shift our focus to the deadline for tax return submission. Article 51 of the decree mandates that taxable persons must file their tax returns within the prescribed manner and no later than nine months from the end of the relevant tax period or as directed by the authority.

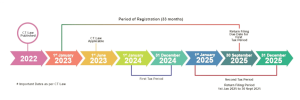

To illustrate the operational aspects, let’s consider two scenarios based on different financial year endings:

1. Financial year ending on May 31st:

- Financial year ending on May 31st:

- The initial tax period spans from June 20, 2023, to May 31, 2024.

- The due date for tax return filing is February 28, 2025.

2. Financial year ending on December 31st:

- The Corporate Tax Law becomes effective from June 1, 2023, but applies to the firm from the subsequent financial year starting January 1, 2024.

- The first tax period covers January 1, 2024, to December 31, 2025.

The due date for tax return filing is September 30, 2026.

It’s important to note that businesses with an accounting period from June 1st to May 31st have a registration period of 26 months, while those with an accounting period from January 1st to December 31st have a registration period of 33 months.

When preparing the tax return, specific information must be included, such as the taxable person’s name, address, and tax registration number. Additionally, the basis of accounting used in the financial statements, the applicable tax period, taxable income, claimed tax loss relief, transferred tax loss, available tax credits, and final corporate tax payable should be clearly stated.

In situations where authorities require specific information, documents, or records to implement the decree law provisions, it is imperative for taxable persons to comply promptly and provide the requested documentation. However, it’s important to bear in mind that if disclosing certain information poses a threat to national security or contradicts public interest, the minister may prescribe an alternative filing form for tax return submission.

To summarize, as a business operating in the UAE, having a comprehensive understanding of corporate tax law and its various aspects is paramount. Familiarizing yourself with the tax period and ensuring timely submission of tax returns is crucial for regulatory compliance, avoiding penalties, and maintaining smooth business operations within the UAE’s corporate tax framework.

Should you have any further inquiries or require professional assistance with your corporate tax obligations, our team of experts is here to support you. We are dedicated to guiding you through your tax journey and helping you navigate the complexities of the UAE’s corporate tax landscape.

Our corporate tax registration is priced at AED500/- ONLY!

Feel free to contact us anytime for personalized support and expert advice on all your tax-related matters.