What is the Role of an MLRO?

The fundamental role of a Money Laundering Reporting Officer (MLRO) in the fight against financial crime and terrorism financing cannot be overstated. The core responsibility of an MLRO is to promptly report suspicious financial activities, information related to financial misconduct, and individuals engaged in such activities to the appropriate authorities.

An MLRO wields the necessary authority and resources to establish an effective compliance framework and instigate essential enhancements. Their profound grasp of business intricacies and structures is matched by a keen awareness of money laundering and terrorism financing risks specific to different industries. Staying abreast of evolving trends and tactics in these areas is a constant commitment for the MLRO.

The pivotal duties of an MLRO encompass not only ensuring adherence to pertinent AML/CFT and KYC regulations but also crafting comprehensive compliance strategies, formulating AML/KYC policies and protocols, and aligning these with established guidelines. Their oversight extends to the extensive implementation of these measures across the organization.

The multifaceted role of an MLRO includes, but is not confined to:

- Conducting thorough risk assessments, a critical task involving understanding, managing, and shaping varying degrees of risk, and producing actionable reports. Clear leadership direction and authorization are imperative in this phase.

- Keeping a vigilant eye on emerging legislation to fortify AML policies, systems, and procedures, ensuring their effective execution.

- Exercising oversight over anti-money laundering (AML), counter-terrorism financing (CTF), and fraud prevention strategies.

- Initiating a comprehensive AML/CFT program by meticulously evaluating business-associated risks. This entails scrutinizing organizational activities, transactions, and relationships to identify potential vulnerabilities to financial crimes and terrorism financing.

- Fostering customer awareness and facilitating the execution of Customer Due Diligence (CDD), a pivotal element of AML and CTF obligations. CDD aids in comprehending customer identities and making decisions based on risk tolerance.

- Recognizing the pivotal role of Suspicious Transaction Reporting (STR) in MLRO efforts. Organizations must adeptly identify and promptly report suspicious transactions. Timely submission of STRs to relevant authorities facilitates the investigation and prevention of financial crimes.

- Designing and implementing internal training initiatives to cultivate expertise and awareness.

- Demonstrating proficiency in assessing money laundering risk, identifying compliance process issues, and offering insightful analyses.

- Demonstrating proficiency in assessing money laundering risk, identifying compliance process issues, and offering insightful analyses.

- Spearheading the adoption of the Know Your Customer (KYC) protocol.

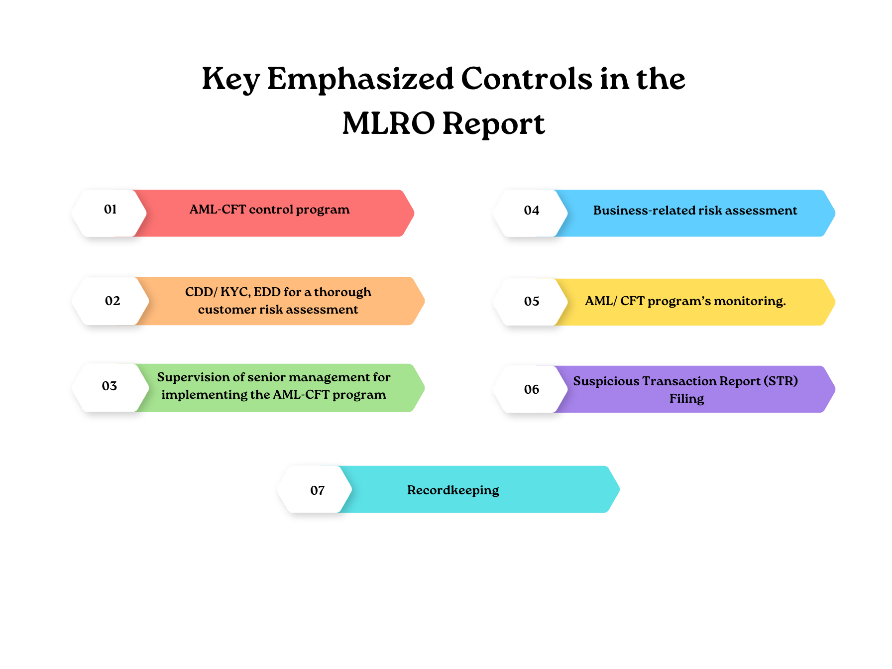

So, what should an MLRO report comprise?

According to Cabinet Decision No 10 of 2019, MLRO reports are to be submitted biannually to senior management, with a copy sent to the supervisory authority concerned. These reports involve a comprehensive review of internal policies and procedures to ensure alignment with AML regulations. They also evaluate the efficacy of companies in AML compliance and the extent of procedural adherence. Furthermore, MLROs play a guiding role, assisting companies in synchronizing with AML policies and reinforcing their compliance programs.

Components in the MLRO Report:

- Review of Suspicious Activity Reports (SARs): Assessing the volume and quality of SARs submitted by employees, along with detailing any rejections due to insufficient information.

- Existing AML-CFT Training: Analyzing the number of courses provided, the extent of employee training, and any related issues. Evidence of training and the company’s competence in adhering to AML/CFT laws should be highlighted.

- Resource Needs for Compliance: Indicating if the company requires additional resources to maintain AML/CFT compliance.

- Customer Due Diligence (CDD) File Review: Mentioning the sample review of CDD files to ensure updated and relevant information.

- Risk Assessment Evaluation: Verifying the relevance and currency of risk ratings and risk assessment reports.

- AML Compliance Process Assessment: Evaluating the company’s adherence to AML/CFT policies, procedures, and documentation.

In conclusion, the MLRO role plays an instrumental part in safeguarding financial systems from illicit activities. Their reports serve as a comprehensive reflection of compliance efforts and provide a roadmap for enhancing anti-money laundering and counter-terrorism financing measures.

In the ongoing battle against financial crime and terrorism financing, the role of a Money Laundering Reporting Officer (MLRO) is indispensable. At Spicer-Pegler, we recognize the critical importance of this role and offer comprehensive support to empower MLROs and organizations in their compliance endeavors.

Tailored Solutions for Effective Compliance:

Spicer-Pegler specializes in crafting customized solutions that align with the unique needs of your organization. Our experts work closely with MLROs to develop and implement robust anti-money laundering (AML) and counter-terrorism financing (CTF) strategies that meet regulatory requirements while adapting to the evolving threat landscape.

Guidance in Regulatory Adherence:

With regulatory landscapes becoming increasingly complex, it’s crucial to stay current with the latest AML/CFT laws and guidelines. Spicer-Pegler provides up-to-date insights and interpretations, ensuring that your compliance efforts remain steadfast and accurate.

Comprehensive Training Initiatives:

Training and awareness are at the core of effective AML/CFT programs. We offer comprehensive training sessions designed to equip your team with the knowledge and skills needed to identify and address potential risks. From basic principles to advanced strategies, our training initiatives cater to diverse skill levels.

Robust Risk Assessment Tools:

Understanding and managing risk is central to MLRO responsibilities. Spicer-Pegler provides cutting-edge risk assessment tools that help you identify, assess, and mitigate risks associated with money laundering and terrorism financing. Our tools offer actionable insights that enhance decision-making and risk management.

Streamlined Compliance Processes:

Navigating compliance can be complex, but it doesn’t have to be daunting. Spicer-Pegler assists in streamlining compliance processes, from customer due diligence (CDD) to suspicious transaction reporting (STR). Our expertise ensures that your procedures are efficient, effective, and aligned with regulatory expectations.

Innovative Technology Solutions:

In a digital age, leveraging technology is essential for staying ahead of financial criminals. Spicer-Pegler offers innovative technological solutions that facilitate data analysis, transaction monitoring, and risk detection. Our tools provide real-time insights that empower MLROs to make informed decisions.

MLRO Reports That Matter:

Crafting comprehensive MLRO reports is vital for showcasing compliance efforts and guiding future strategies. Spicer-Pegler assists in creating impactful reports that highlight key metrics, training outcomes, risk assessment results, and compliance process evaluations. Our reports are designed to meet regulatory requirements while offering strategic insights.

Strengthen Your Financial Integrity:

Spicer-Pegler is your partner in the pursuit of financial integrity. With a deep understanding of industry intricacies and a commitment to proactive compliance, we stand by your side as you combat financial crime and terrorism financing. Together, we can create a more secure financial landscape.

Strengthen your compliance initiatives and build a robust defense against illicit activities. Contact us today to embark on a journey toward enhanced financial security.